Answer: No

Most of the time while we are trading stocks, we think if we are going to make profit out of it or not. This is the world of stock. A direct link between risk and stock is attached. Something goes wrong, the price changes and it increases risk. Something goes right again price changes. Nobody is certain in the world of stock market. The only thing that is certain is "Change". Some people like it and some hate change. But it's inevitable.

Type of stocks:

1.Preference stock

2.Common stock

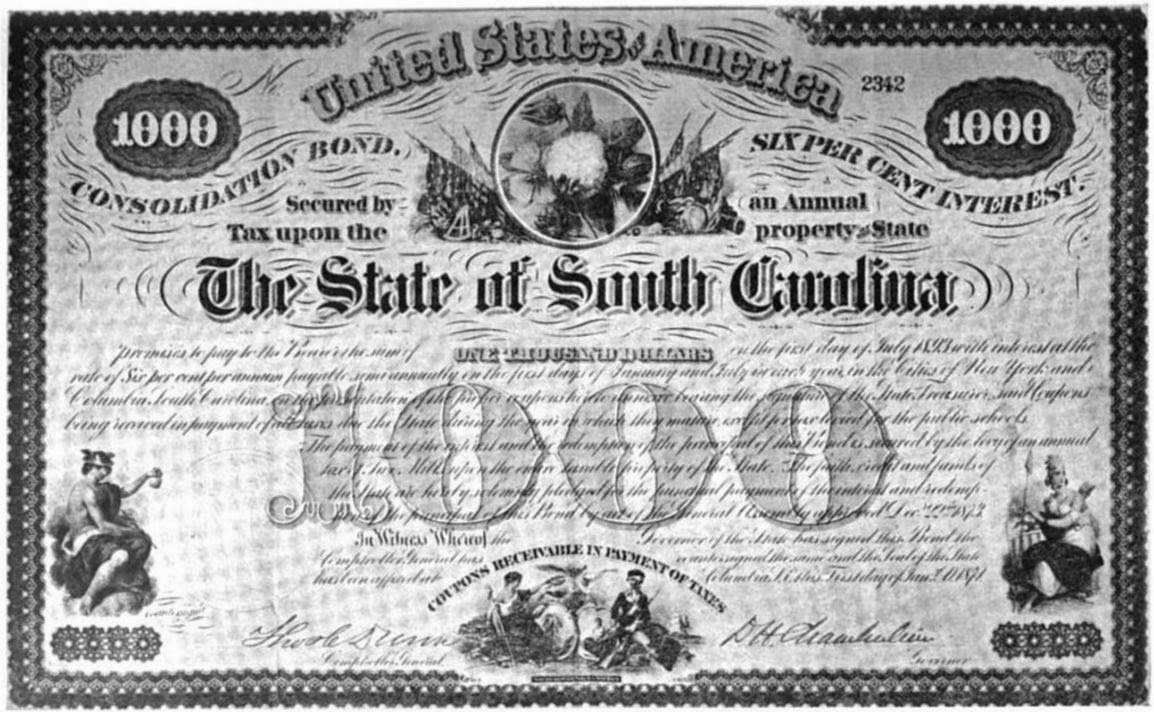

Types of bond:

1.Government Bond

2.Corporate Bond

Stocks pay dividend right?

Yes, it does and it depends on the general meeting of the company. Sometimes dividend is paid and sometimes it's not.

Bond pay interest twice a year.

Also, the bond holders are the in high priority if the company is bankrupt.

Stocks are sold in the stocks market. Sometimes they are sold far more higher value than expected. A simple stock purchased at $100 could be sold at $500 and $400 profit could be easily realized. It happens with bond too but bonds are not traded in such high valuation state. This means, if a investor is willing to take risk then, bonds are much safer than stocks, where as stocks are best options to take opportunity.

Which one is more profitable then?

It depends on what is the need, safe investment or high risk investment and greater return. Combination of them could be a great portfolio.

Perfectly structured… Love reading all of it!!! I need to know what is premium within option trading is this last exchanged price multiplied by great deal size or not, otherwise how to calculate choices premium?????? And also guidance is it good to make use of options, who invest within equity for past 12 months? Thanks in advance!!!!

ReplyDelete