Greed is intense and selfish desire for something, especially wealth, power, or food. Greed is the single behavior that has changed the course of history so many times. From normal people to great kings and queens, greed has captured the heart of many powerful people and some people later became powerful because they were greedy. This, sometimes put people in confusion, whether to have greed or not. People are rational and they are seek for a logical explanation of what ever action they do, so if someone is greedy, then they want to give justification for that. The rational for being greedy could be anything but what matters here is whether being greedy is good or bad. Here, in this post we will be concentrating on stock markets.

Each day we encounter many opportunities, each day we find people around us so hungry for what they are seeking and each day we find more greed in places where there is scarcity. If a stock is low on supply there will be people who want to have that stock. Greed works. This happens because we all are raised up like that. As kids our parents showed us how we are more valued than other's children. We were given good care, we were given more attention and we were raised properly. There we learned there are things in this world that belong to us and they are owned by us, we should try to protect them. The very feeling that there are certain things that are ours makes us greedy because we start to feel that we need to protect them. By protecting it means not losing them. Profits, bonuses and more profits and bonuses, all are different parts of what a man wants when there is greed in his mind.

Here's Gekko's speech:

Whether you put a bid on a blue chip stocks or a penny stocks, it's greed that's going to make you a stock market genius because you always want more and more. What's so amazing is that it's a clearly stated and willingly done gamble where outcomes seem so precise yet nobody knows what's going to happen next and who is thinking what. So, it's a good business because you are not robbing or anything else. It's just finely defined game and the players are all greedy. Greed here is so good that even the most promisingly philanthropic person seem to have some desire that's not yet fulfilled.

It's greed that runs the stock markets, it's greed that makes a banker to put ambitious goals for his employee and high bonuses for them, it's greed that makes you buy coupons which will save you money and it's greed that makes everyone alive in this world. " Investors are piling into the shares of small, risky companies at the fastest clip on record, in search of investments that promise a chance of outsize returns." The Wall Street Journal.(Read More) More amazingly, the desire to lose less while producing something increases the efficiency of the company.

And it's greed that makes you to read this post because you want to know a little more than others. So, it's true greed is good, but, the greed that serves not only you but who ever is in your circle, it's better. We want leaders who wants to think not only for himself.

Trading Tips and Market Analysis for Stocks Traders. International Stock Exchange,DJIA,Nasdaq,S&P 500,NYSE, Dow Jones, Russell 2000 and NEPSE, CDS, News, Stock Updates, Stocks triggers

Saturday, May 24, 2014

Tuesday, May 20, 2014

Sagarmatha Insurance Company Limited's AGM for providing 42.1% dividend, including 20% bonus share

Sagarmatha Insurance Company Limited's AGM is scheduled for June 19 :

Note:

Shareholders who already hold the scrip of the company till June 4 will be entitled to the dividend.

It will propose to endorse

42.1 percent dividend

20 percent bonus shares

22.1 percent cash

to its shareholders from the net profit it earned in the last fiscal year 2069/70.

The company has net profit of Rs 17.79 crore in the last fiscal year.

It will also elect six directors from among the promoters and two from group of ordinary shareholders

Note:

Shareholders who already hold the scrip of the company till June 4 will be entitled to the dividend.

It will propose to endorse

42.1 percent dividend

20 percent bonus shares

22.1 percent cash

to its shareholders from the net profit it earned in the last fiscal year 2069/70.

The company has net profit of Rs 17.79 crore in the last fiscal year.

It will also elect six directors from among the promoters and two from group of ordinary shareholders

Sunday, May 18, 2014

Nepal Telecom: 1.29 marginal profit increase

Nepal Telecom's marginal profit is up by 1.29 percent in the third quarter of the current fiscal year 2070-71.

Net profit = Rs 8.60 arba, last time it was Rs 8.49 arba(same quarter last year)

Provision for income tax = Rs 2.76 arba

Current liabilities stand at 1.60 arba.

EPS = Rs 74.57

Net worth per share = Rs 395.86.

Net profit = Rs 8.60 arba, last time it was Rs 8.49 arba(same quarter last year)

Provision for income tax = Rs 2.76 arba

Current liabilities stand at 1.60 arba.

EPS = Rs 74.57

Net worth per share = Rs 395.86.

|

| Nepal Doorsanchar Company Limited: Click to enlarge |

Saturday, May 17, 2014

Candlestick Chart: Why Candlestick Chart is used in stock market?

Candlestick Chart: Information about emotions.

Munehisa Homma (Japanese) in 1700s, who traded the futures market discovered that emotions are always involved during trading in the market. There was impact of supply and demand but the trader's emotion was also an important factor to be considered.

Homma found that if he could understand the emotions of traders in the market, he could be able to predict what would happen next in future. The next thing to find was difference between buying price and value of rice he used to trade. This difference is still considered during trading in stock market. All these are based on Candlestick Chart analysis.

Even though there are various rule and indications about when you should sell your stock, Candlestick Chart gives the emotional reason to that question.

We have no bull or bear in the chart. But we have fear and greed in the chart. These information are always vital because they are the basis for trading. In the chart, greed means many people what to purchase the same stock and price goes up which is bullish market trend and if people fear about the decline in price they sell at some amount shorter than opening amount and bearish market trend is seen. So information is vital for traders whether it's regarding emotion or trend, the whole point is to find the best price to sell and purchase.

In case of fear, people are careful with the profit margin. They do not want to reduce the profit margin so they now start to sell even if small red candle are seen in the cart. They all are conscious about reducing the opportunity loss as well. They do have rules or they follow someone's rule while trading stocks.

Munehisa Homma (Japanese) in 1700s, who traded the futures market discovered that emotions are always involved during trading in the market. There was impact of supply and demand but the trader's emotion was also an important factor to be considered.

Homma found that if he could understand the emotions of traders in the market, he could be able to predict what would happen next in future. The next thing to find was difference between buying price and value of rice he used to trade. This difference is still considered during trading in stock market. All these are based on Candlestick Chart analysis.

Even though there are various rule and indications about when you should sell your stock, Candlestick Chart gives the emotional reason to that question.

We have no bull or bear in the chart. But we have fear and greed in the chart. These information are always vital because they are the basis for trading. In the chart, greed means many people what to purchase the same stock and price goes up which is bullish market trend and if people fear about the decline in price they sell at some amount shorter than opening amount and bearish market trend is seen. So information is vital for traders whether it's regarding emotion or trend, the whole point is to find the best price to sell and purchase.

The small greed pattern normally indicated that traders are willing to purchase the stock or anything that the chart represent. Greed for stocks make them to purchase with the anticipation that stocks might go up.

In case of fear, people are careful with the profit margin. They do not want to reduce the profit margin so they now start to sell even if small red candle are seen in the cart. They all are conscious about reducing the opportunity loss as well. They do have rules or they follow someone's rule while trading stocks.

Tuesday, May 13, 2014

NIC Asia has 62.89% net profit rise in third quarter.

NIC Asia has 62.89% net profit rise.

Accoring to the unaudited financial report (for the third quarter today),

Net profit = Rs 62.73 crore

Net interest income = Rs 1.30 arba

Provisioning = Rs25.61

Deposit= Rs 40.56 arba

Loan = Rs 33.29 arba

Non-performing loan increment = 2.77 percent

EPS = Rs 36.18

Net worth per share = Rs 216.97

P/E ratio= 20

Accoring to the unaudited financial report (for the third quarter today),

Net profit = Rs 62.73 crore

Net interest income = Rs 1.30 arba

Provisioning = Rs25.61

Deposit= Rs 40.56 arba

Loan = Rs 33.29 arba

Non-performing loan increment = 2.77 percent

EPS = Rs 36.18

Net worth per share = Rs 216.97

P/E ratio= 20

|

| Click to enlarge. NIC Asia. |

Sunday, May 11, 2014

Standard Chartered Bank, Rs 1 billion net profit,17.86 percent increase in net profit

Standard Chartered Bank Limited has 17.86 percent increase in net profit compared to 2069/70.

According to the financial report(unaudited) for the third quarter,

Net profit = Rs 99.94 crore.

Operating profit = Rs 2.15 arba

Provision = Rs 11.89 crore.

Reduction in performing loan = 0.52 percent

Deposits= Rs 42.95 arba

Loan = Rs 27.01 arba

EPS = Rs 65.27

Net worth per share= Rs 274.50

P/E ratio =27.85 times

According to the financial report(unaudited) for the third quarter,

Net profit = Rs 99.94 crore.

Operating profit = Rs 2.15 arba

Provision = Rs 11.89 crore.

Reduction in performing loan = 0.52 percent

Deposits= Rs 42.95 arba

Loan = Rs 27.01 arba

EPS = Rs 65.27

Net worth per share= Rs 274.50

P/E ratio =27.85 times

Saturday, May 10, 2014

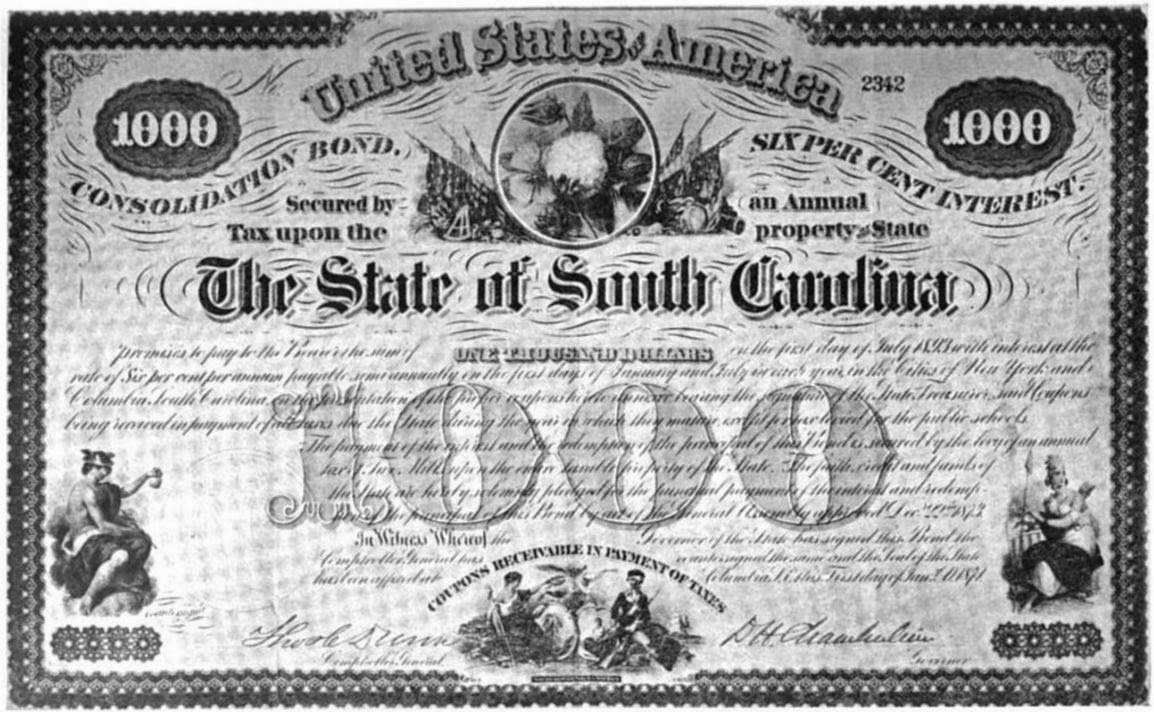

What type of person you are? Bond holder or Stock Holder?

There is various differences between Stocks and Bonds, but both are used for capital formation.

Diffen is also clear about the various dimensions we can find distinct about these two.

In this post we are discussing about what kind of person you are and what should you be holding.

Characteristics of Bond holder:

1. They are not interested in trading bond after holding it. They might sell sometimes but not like the way stocks holders do.

2. Bond holders wait for interest.

3. They own the bond of public sector authorities, credit institutions, companies and supranational institutions.

4. They are attracted by the constant return they will get in regular time interval.

5. They avoid the risk as much as they can. They don't want to worry about the stock price they hold.

6. The inflation worries bond holder.

7. Interest rate affects the opportunity loss.

8. They are committed for long time. And it's really a long time.

Characteristics of Stock holder:

- Most of them are always the traders and rest don't care, they simply hold. More than that, they are owners of the company. They own certain portion of the company whose stock they hold.

- Interest rate, inflation and maturity periods are least considered by a stock trader. These things does not force the stock traders to hold or sell his stocks.

- They have their own rules for playing in stock market.

- Stock holders do not settle for certain amount of money for regular interval of time.

- They seek opportunity in loses. They lose sometimes and they gain sometimes but they don't depend on certain amount for stability.

- They diversify and they are always up to date.

They invest in both. They invest in bond as well as share. They choose to invest in highest paying bond and they learn when to sell. This is used for minimizing the risk.

Decided which type of people you are after reading the characteristics? Please feel free to express.

Friday, May 9, 2014

Ace Development Bank, 286.50%, thinking to buy? Purchasing Stocks of Ace.

Ace Development Bank Limited's third quarter net profit shore up by 286.50 percent.

In the unaudited financial report for the third quarter published today, the bank has stated that its net profit has increased to Rs 4.83 crore from a loss of Rs 2.59 crore as compared to the corresponding quarter of the last fiscal year 2069/70.

Bet interest income = Rs 19.60 crore

Provision for possible loss = Rs 8.12 crore

Deposits= Rs 5.96 Arba

Loan=Rs 4.34 Arba

EPS = Rs 7.79

Net worth per share = Rs 118.82

P/E ratio= 23.50 times.

Closing at may 8=Rs 204.00

Click to enlarge.

Is there anything that might interest stock traders in the bank?

Well, 286.50% of profits in 3rd quarter is the key attraction for the stock traders. Further more, right now the price may go up or down, nobody knows and we should act accordingly.

In the unaudited financial report for the third quarter published today, the bank has stated that its net profit has increased to Rs 4.83 crore from a loss of Rs 2.59 crore as compared to the corresponding quarter of the last fiscal year 2069/70.

Bet interest income = Rs 19.60 crore

Provision for possible loss = Rs 8.12 crore

Deposits= Rs 5.96 Arba

Loan=Rs 4.34 Arba

EPS = Rs 7.79

Net worth per share = Rs 118.82

P/E ratio= 23.50 times.

Closing at may 8=Rs 204.00

Click to enlarge.

Well, 286.50% of profits in 3rd quarter is the key attraction for the stock traders. Further more, right now the price may go up or down, nobody knows and we should act accordingly.

Wednesday, May 7, 2014

Net profit of 223.39 percent,Machhapuchhre Bank Limited, Next hot Stock in NEPSE

May 7, 2014-Stocks to buy:

Machhapuchhre Bank Limited.

Today's Closing Price: Rs. 488,

With the unaudited third quarterly report published, the appreciation in the price of the share of the bank is seen to be the probable option for now. The profit of Machhapuchhre Bank is up by 223.39% in the quarter. It was Rs. 9.83 Crore in the corresponding quarter last fiscal year and now it's Rs. 31.79 Crore.

There is decrease in Non-performing loan by 2.73 %.

EPS= Rs. 17.1

Net worth pershare= Rs. 125.79

Machhapuchhre Bank Limited.

Today's Closing Price: Rs. 488,

With the unaudited third quarterly report published, the appreciation in the price of the share of the bank is seen to be the probable option for now. The profit of Machhapuchhre Bank is up by 223.39% in the quarter. It was Rs. 9.83 Crore in the corresponding quarter last fiscal year and now it's Rs. 31.79 Crore.

There is decrease in Non-performing loan by 2.73 %.

EPS= Rs. 17.1

Net worth pershare= Rs. 125.79

Sunday, May 4, 2014

Mega Bank, Q3 net profit up by 98%

Mega Bank,

According to the unaudited quarterly report for the third quarter, the bank's net profit is up by 98 percent. It was Rs 13.01 crore and now it's Rs 25.79 crore.

There is increase in interest income from Rs 50.58 crore to Rs 61.49 crore.

Foreign Exchange Gain = Rs. 8.49 crore

Deposit=Rs.17.05 Arba

Loan=Rs. 15.25 Arba

Provisions: Rs. 6.28 Crore

EPS= 11.07

Net worth per share= 116.31.

According to the unaudited quarterly report for the third quarter, the bank's net profit is up by 98 percent. It was Rs 13.01 crore and now it's Rs 25.79 crore.

There is increase in interest income from Rs 50.58 crore to Rs 61.49 crore.

Foreign Exchange Gain = Rs. 8.49 crore

Deposit=Rs.17.05 Arba

Loan=Rs. 15.25 Arba

Provisions: Rs. 6.28 Crore

EPS= 11.07

Net worth per share= 116.31.

Saturday, May 3, 2014

Stocks Vs Bond, Which is more profitable?

Question: Are both of them, Stocks and Bond, risk free?

Answer: No

Most of the time while we are trading stocks, we think if we are going to make profit out of it or not. This is the world of stock. A direct link between risk and stock is attached. Something goes wrong, the price changes and it increases risk. Something goes right again price changes. Nobody is certain in the world of stock market. The only thing that is certain is "Change". Some people like it and some hate change. But it's inevitable.

Type of stocks:

1.Preference stock

2.Common stock

Bond comes with the promise of safe investment. They promise the holder certain rate of return that is paid by the issuer. But, in this uncertain world, who promises the better future of the company that issues bond? Who knows if it's not going to collapse? Nobody. So, it may give certain payment in regular interval and par value after certain time, but only if the company sustain till then.

Types of bond:

1.Government Bond

2.Corporate Bond

Stocks pay dividend right?

Yes, it does and it depends on the general meeting of the company. Sometimes dividend is paid and sometimes it's not.

Bond pay interest twice a year.

Also, the bond holders are the in high priority if the company is bankrupt.

Stocks are sold in the stocks market. Sometimes they are sold far more higher value than expected. A simple stock purchased at $100 could be sold at $500 and $400 profit could be easily realized. It happens with bond too but bonds are not traded in such high valuation state. This means, if a investor is willing to take risk then, bonds are much safer than stocks, where as stocks are best options to take opportunity.

Which one is more profitable then?

It depends on what is the need, safe investment or high risk investment and greater return. Combination of them could be a great portfolio.

Answer: No

Most of the time while we are trading stocks, we think if we are going to make profit out of it or not. This is the world of stock. A direct link between risk and stock is attached. Something goes wrong, the price changes and it increases risk. Something goes right again price changes. Nobody is certain in the world of stock market. The only thing that is certain is "Change". Some people like it and some hate change. But it's inevitable.

Type of stocks:

1.Preference stock

2.Common stock

Types of bond:

1.Government Bond

2.Corporate Bond

Stocks pay dividend right?

Yes, it does and it depends on the general meeting of the company. Sometimes dividend is paid and sometimes it's not.

Bond pay interest twice a year.

Also, the bond holders are the in high priority if the company is bankrupt.

Stocks are sold in the stocks market. Sometimes they are sold far more higher value than expected. A simple stock purchased at $100 could be sold at $500 and $400 profit could be easily realized. It happens with bond too but bonds are not traded in such high valuation state. This means, if a investor is willing to take risk then, bonds are much safer than stocks, where as stocks are best options to take opportunity.

Which one is more profitable then?

It depends on what is the need, safe investment or high risk investment and greater return. Combination of them could be a great portfolio.

Friday, May 2, 2014

Siddhartha Bank, May 2, 2014, Stocks to buy

Last year the net profit of Siddhartha Bank was Rs. 28.87 Crore and this year the profit has increased up to Rs. 36.67 Crore.

It currently has Rs 32.47 Arba in deposit and Rs 25.31 Arba in loan.

EPS= Rs 26.74

Net worth per share = Rs 158.03.

P/E ratio = 21.21

Net assets value per share = Rs 2,093.25.

It's recommended for now to purchase the stocks of Siddhartha Bank if you are a trader.

It currently has Rs 32.47 Arba in deposit and Rs 25.31 Arba in loan.

EPS= Rs 26.74

Net worth per share = Rs 158.03.

P/E ratio = 21.21

Net assets value per share = Rs 2,093.25.

It's recommended for now to purchase the stocks of Siddhartha Bank if you are a trader.

Thursday, May 1, 2014

Stocks to buy:Kumari Bank

Kumari Bank has 5.8% growth in profit compared to last year.

Now, the bank's 13 AGM has decided to provide 14% bonus share and 0.74 % cash dividend.

With new director Santosh Kumar Lama there's a promising future of bank.

Now, the bank's 13 AGM has decided to provide 14% bonus share and 0.74 % cash dividend.

With new director Santosh Kumar Lama there's a promising future of bank.

Prabhu Bikas Bank, April5,2014, Stocks to buy.

With net profit of Rs. 7.92 crore which was Rs. 2.53 crore last year, Prabhu Bikas Bank is a hot stock.

There was net interest income of Rs 26.68 crore in the third quarter.

There was net interest income of Rs 26.68 crore in the third quarter.

Best Five Stock Markets

Here's a list of five Stock Markets you might want to consider for your trading activity. The rules of buying and selling the stocks are same. Sometimes you will make money and sometimes you will not make more money. But, you will make money if you are a expert on making a great deal. So:

1.NASDAQ

1.NASDAQ

With 24 markets, 3 clearinghouses and 5 central securities depositories supporting equities, options, derivatives, commodities, futures and structured products, NASDAQ is the second largest stock exchange market in the world.

2. Tokyo Stock Exchange:

94 domestic and 10 foreign securities companies participate in TSE trading.

3.Shanghai Stock Exchange:

Even though it's not completely open for foreigners, there are funds, bonds and stocks traded in it.

4.London Stock Exchange:

With 70 countries and 3000 companies listed on the market, it's one among five.

5.NYSE

With 8000+ companies listed in it and many financial products, it provides soaring opportunities for traders.

Subscribe to:

Posts (Atom)

Popular Posts

-

245 million shares of Tesco is sold by Berkshire Hathaway investment company. 245 million shares of Tesco is sold by Berkshire Hathaway...

-

It was the month of march, new CEO of smartphone manufacturer BlackBerry is facing hard time taking control of financial situation of the co...

-

IBM and Coke may be losing money, but Buffett's largest position, Wells Fargo, has raised 11% this year. Warren Buffett has lost ...

-

Adidas announced plans to return as much as 1.5bn euros (£1.2bn) to shareholders over the next three year Everything was fine after Adid...

-

Traders make the whole market move. The make it go up or go down. "I believe the very best money is made at the market turns. Every...

-

Trading involves dedication and awareness. Dedication provides the willingness to be in the game while awareness makes trader exposed to the...

-

The magazine world is filled with so much variety and it's a challenge that people, mostly investors have to face: Which is the best fin...

-

"Name of the game: Move the money from your client's pocket into your pocket." "But if you can make client money, it'...

-

Every trader has to face loss at some point in their lives. The only thing that matters is the teachings it leaves when others take your m...

-

Nepal Stock Exchange has published vacancy notice. Click the link below to download the file. Vacancy by NEPSE.